SPACgetti

Since we’re talking SPACs, what follows is not financial advice, for entertainment and informational purposes only, etc.

Listen. I know. I promised myself the next post would be a nice deep dive into noise protected qubits or something of the sort. It was going to take a week or two of reading, I was going to make some crude, yet charming, hand-drawn figures. Instead what happened is that Rigetti announced they’re going to go public via SPAC.

So, honestly, my take on this is that if God didn’t want me to write another SPAC post, He wouldn’t have let Chad announce this for at least another month. So here we are. Another SPAC post, and you know what that means: another funny little investor presentation.

The Investor Presentation

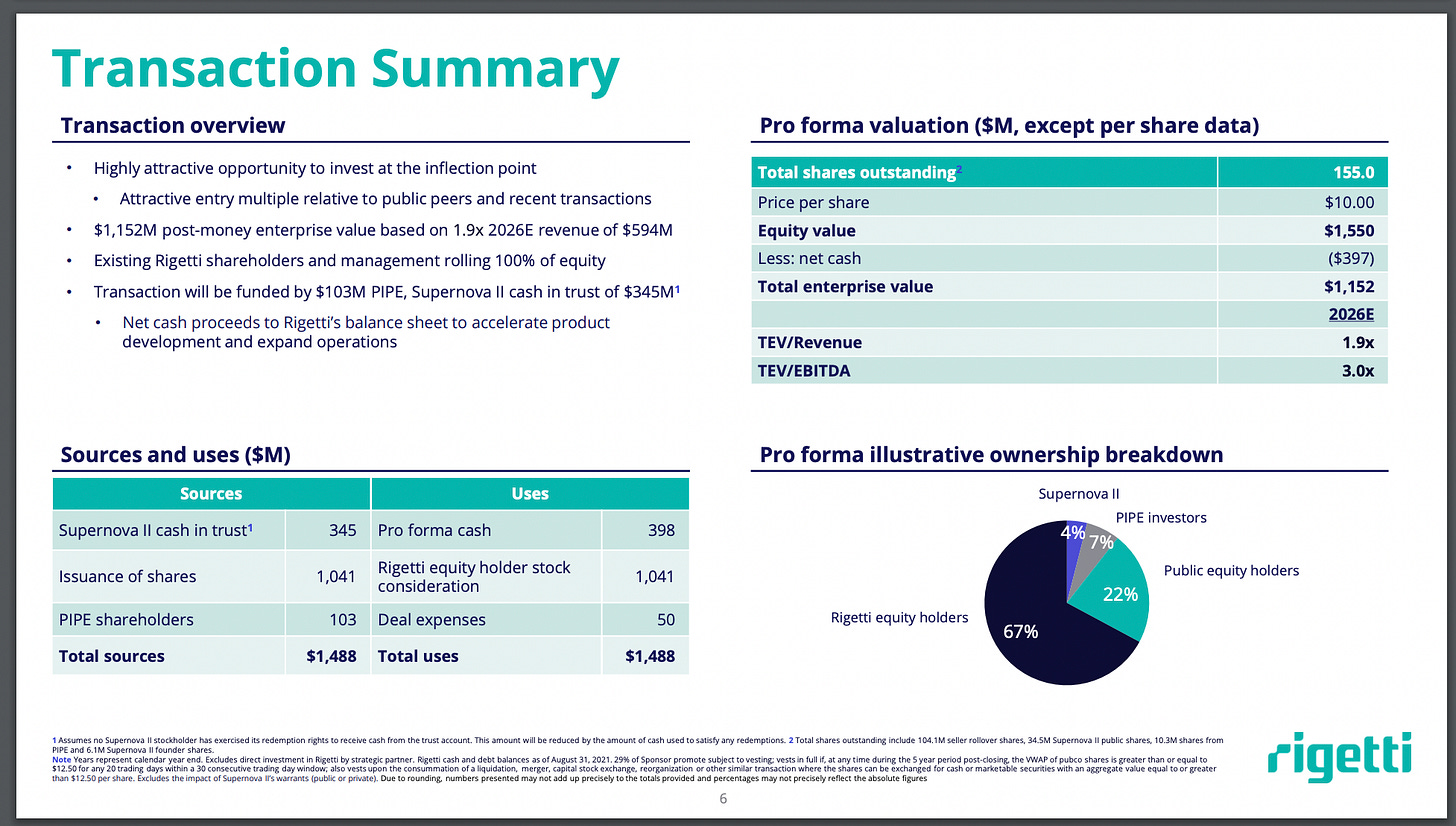

First the transaction at a glance: it looks like Rigetti will be valued at $1.5B. This seems a little odd to me. IonQ was valued at ~$2B, but Rigetti has built their own cleanroom and fab to make their own chips, have more people, and I think dilution refrigerators cost more than the ion-trap UHV + lasers setup, but not too sure on the last point. Lasers can get pretty expensive, and ultra-high vacuum is not exactly easy to get. In short, I expected this valuation to be closer to, or above that of IonQ.

Proceeds are going to be around $450M, less than the ~$600M IonQ received, but Rigetti has also raised way, way more money than IonQ, so that might be fine?

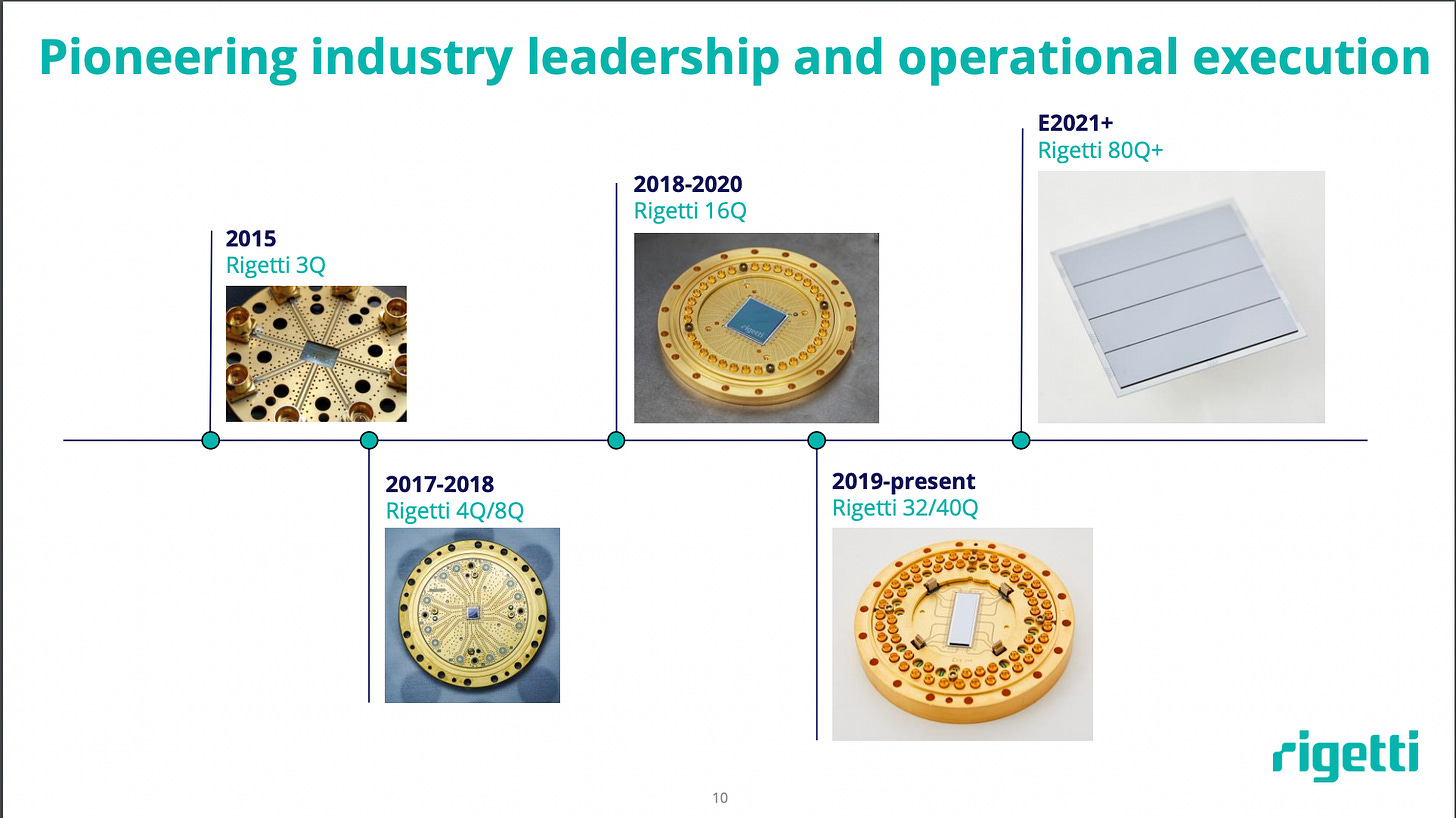

The near-term timeline has us getting wow’d by the Rigetti 80 qubit processor by the end of 2021. A more hardened gambler than I might be tempted to offer odds on who debuts their 2021 processor first: IBM with their 128 qubit QPU, or Rigetti with the 80 qubit QPU?

Then there’s this regrettable slide:

I hate this trope of the ‘simultaneous computing’ to explain QC. Honestly, I am not really sure I can articulate *why* quantum computers should be more powerful (in some cases) than classical ones. Is it the Hilbert space? Is it some clever consequence of quantum mechanics that lets us construct algorithms that force the probability amplitudes for wrong answers to go to zero? Is it something else? A combination of these things? I AM pretty sure it ain’t “all solutions are tested simultaneously”, though.

Following this there are the usual implications that quantum computing will help drug discovery, fusion power (read: simulating nuclear weapons so we don’t have to actually test them), and portfolio optimization. Rigetti has partners interested in all of these things and are presumably working on some toy problems on the Rigetti QPUs.

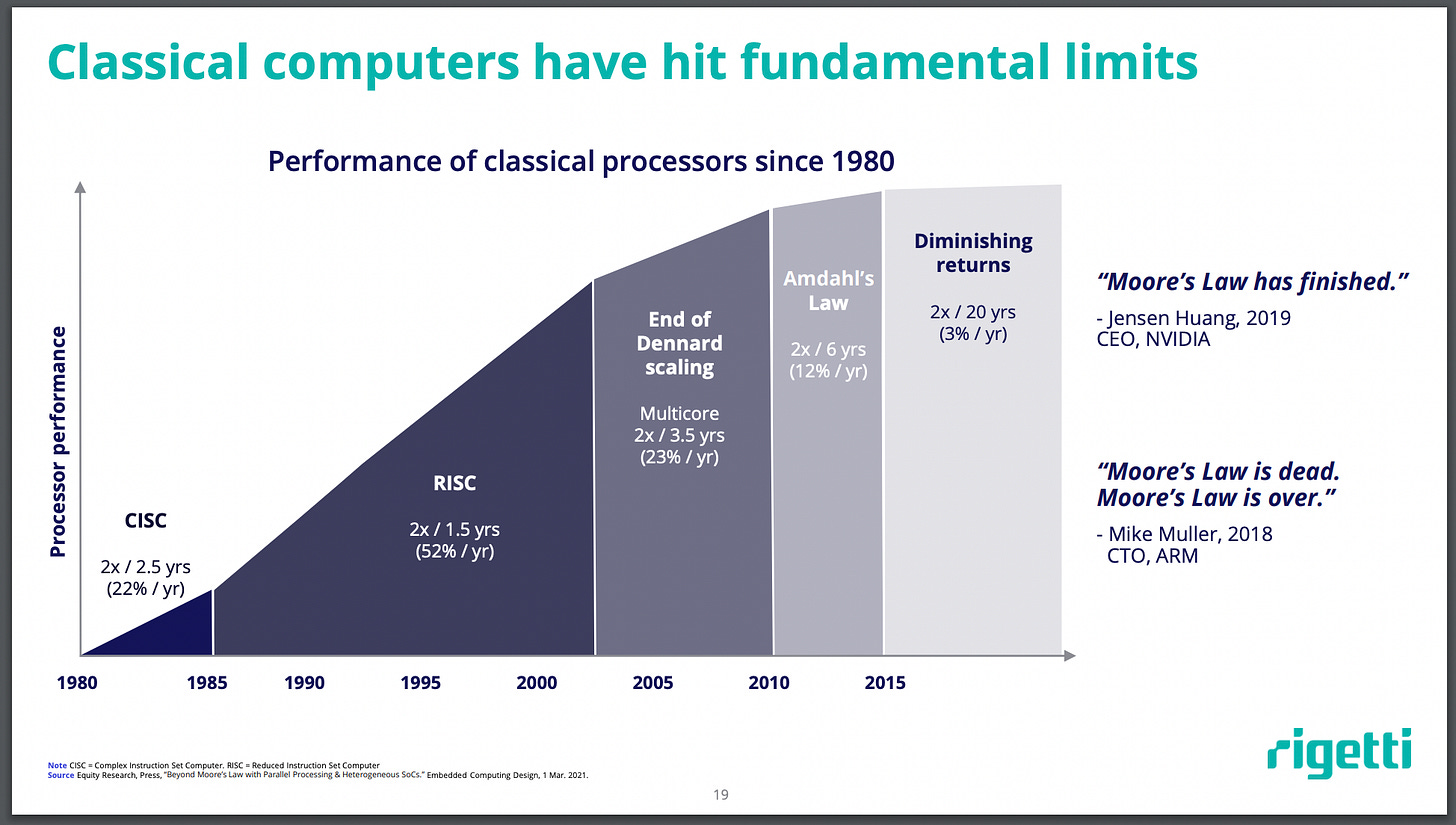

One figure I haven’t seen much is something like the one on slide 19:

Never heard of Dennard scaling, or Amdahl’s Law before today, but I am familiar with Diminishing Returns. The ambiguity here is ‘Performance’ on the y-axis. I think implicitly performance is sometimes a stand-in for transistor density, but it could also plausibly be processor clock speed. Amdahl’s Law has to do with speed-ups due to increased system resources, and is often applied to parallel computing cases.

The implication here is that quantum computing will be categorically better than classical. This is, of course, false. Quantum computing will be better for some use cases than classical computing. For all else we will enjoy some Diminishing Returns (or Reversible Computing).

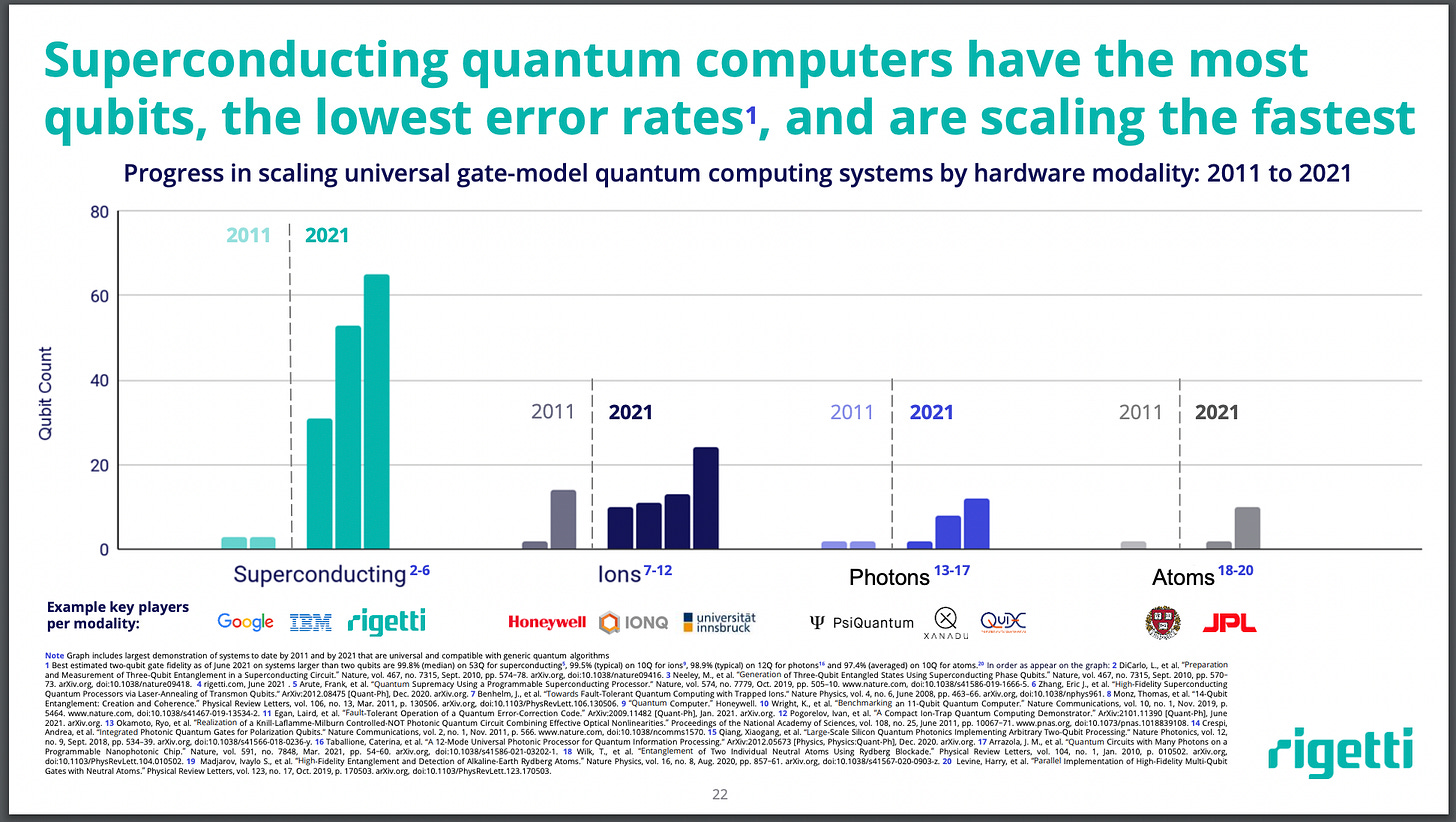

Then there’s this very interesting slide about the merits of superconducting qubit architectures over all others:

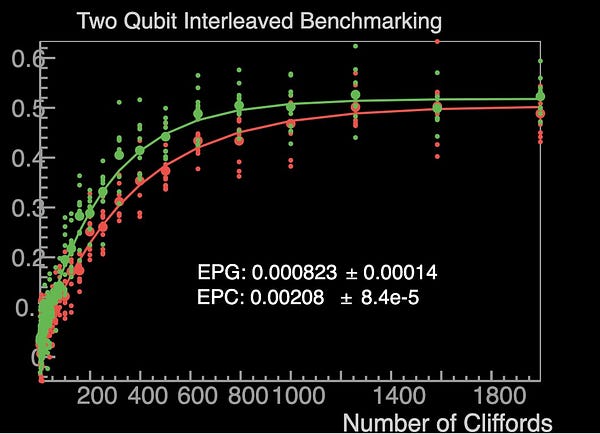

The footnotes are the interesting part here. What this slide does is ride on the success of other superconducting QC teams and suggest that this should make you feel good about Rigetti. In fact, if you read the footnotes, you’ll see that the reason you can make the claim that SC qubits have the best error rates is because Google has 99.8% 2-qubit gate fidelity, beating IonQ by about 0.3%.

This was true at the time of investor presentation creation, but if you are willing to believe Jay Gambetta, IBM now has the best error rates, showing 3 9s of fidelity in their latest revision to the Falcon processor.

As we’ll see later, Rigetti is relatively far from reaching these 2 qubit gate fidelities.

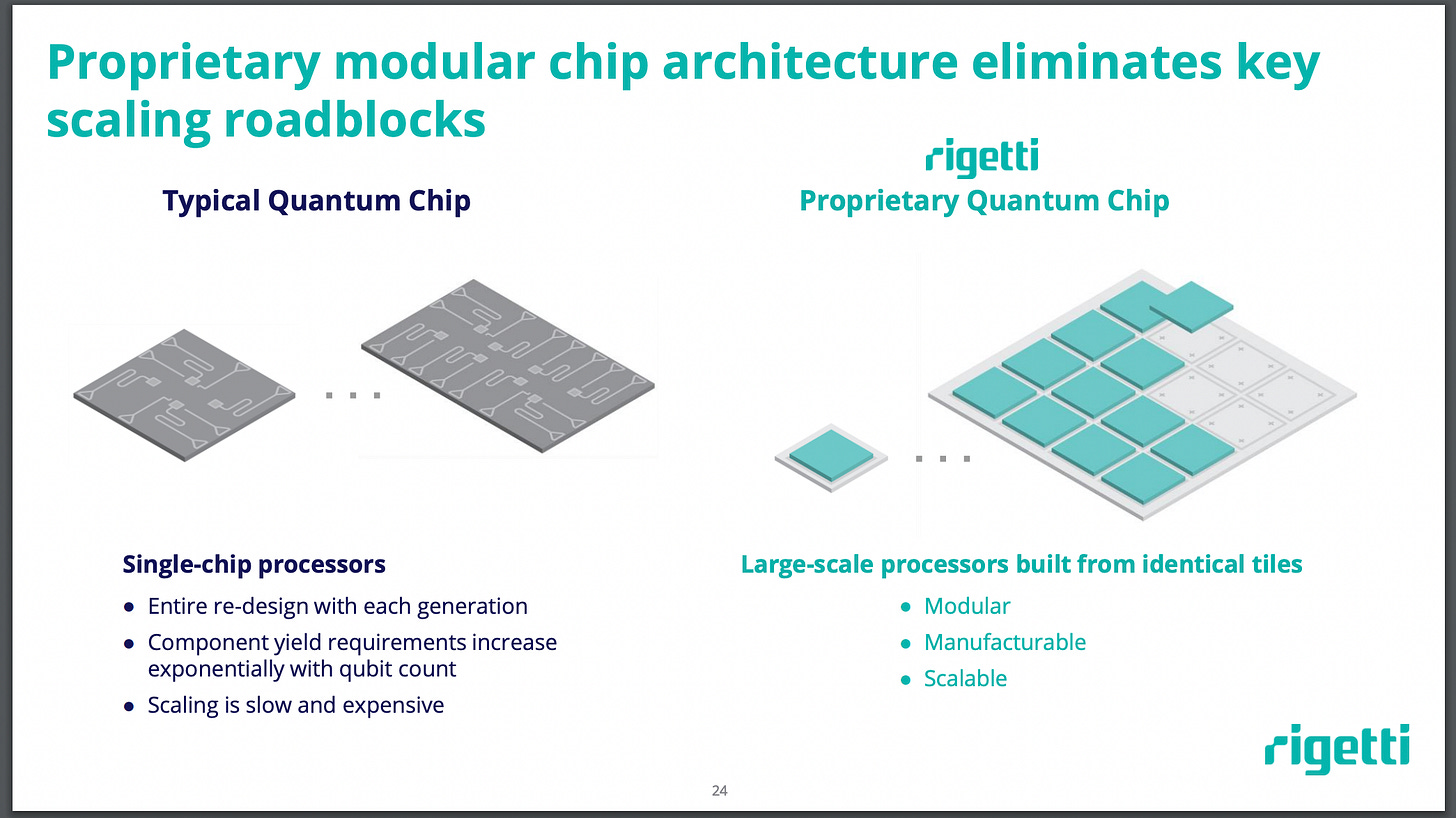

A few slides later we’ll get to the relatively cool stuff, the modular architecture.

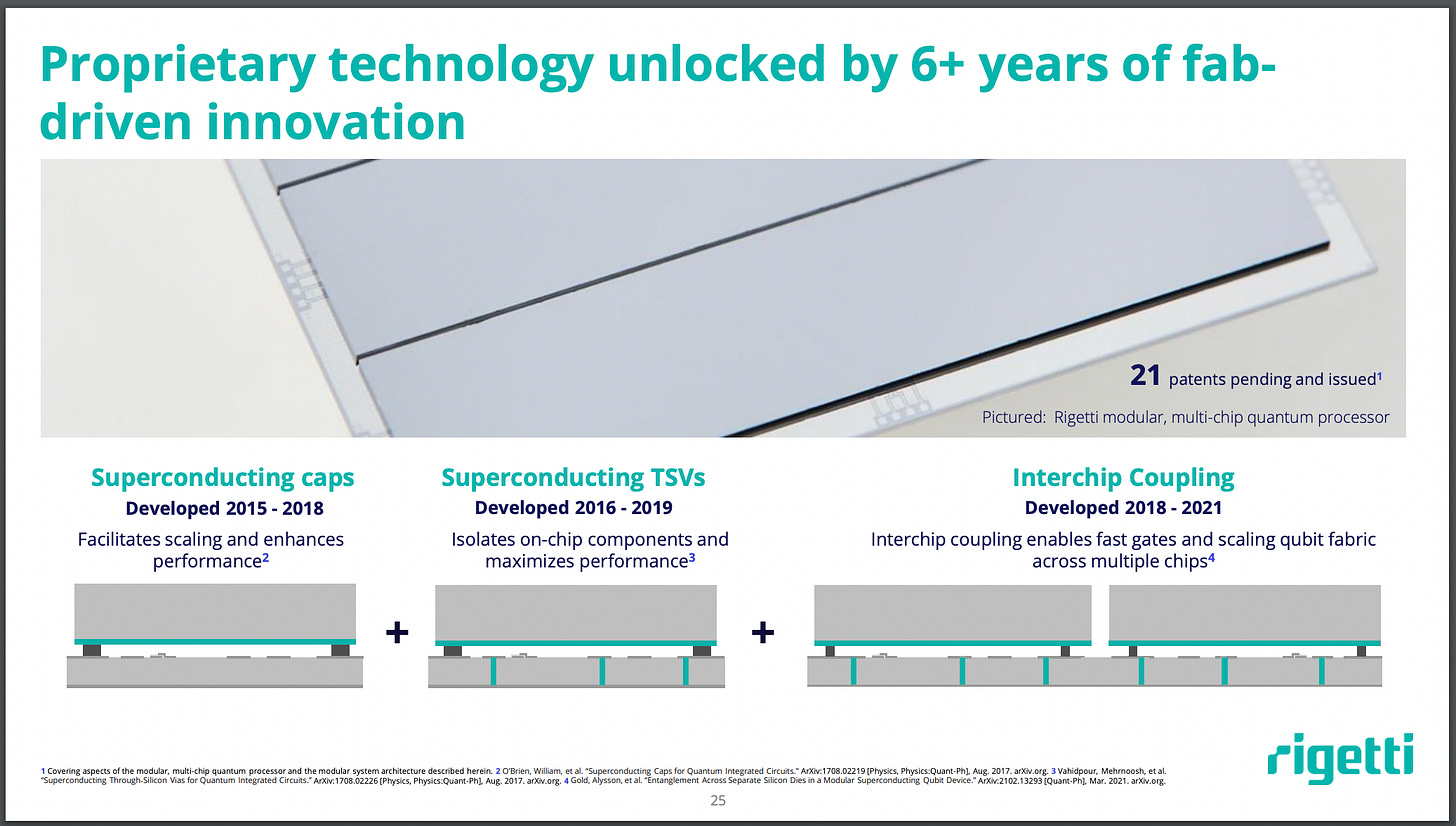

I like this modular chip architecture with a large carrier chip, presumably chock-full of wiring and signal traces going to and between rider chips. The next slide also shows off some of their additional fab successes.

Here are the publication references in the footnote- superconducting caps, TSVs, Interchip Coupling. Good TSVs and reliable interchip coupling seem especially hard to me. Patterning Al through a 50 µm wide hole in a 250 µm thick chip is… non-trivial. The aluminum has to make it all the way or your TSV is useless!

Similarly, flip chip coupling seems pretty simple, just flip the chips, slam them together and boom, you’ve got your coupling density and qubit density sorted. However, when you try to bond two chips together, not only are you facing uncertainty in Z direction separation (Rigetti observed height spreads between 1.5 - 4 µm), but also in X and Y, not to mention rotations! Z uncertainty alone changed their coupling strengths by a factor of 3 (from 8.8 MHz to 26 MHz). Rotations or X-Y translations could selectively cripple devices depending on their coupler orientations in the design. It’s cool that they solved it and seemed to be able to get in the 90% range for some of their CZ fidelities on what I’d consider a proof-of-concept experiment.

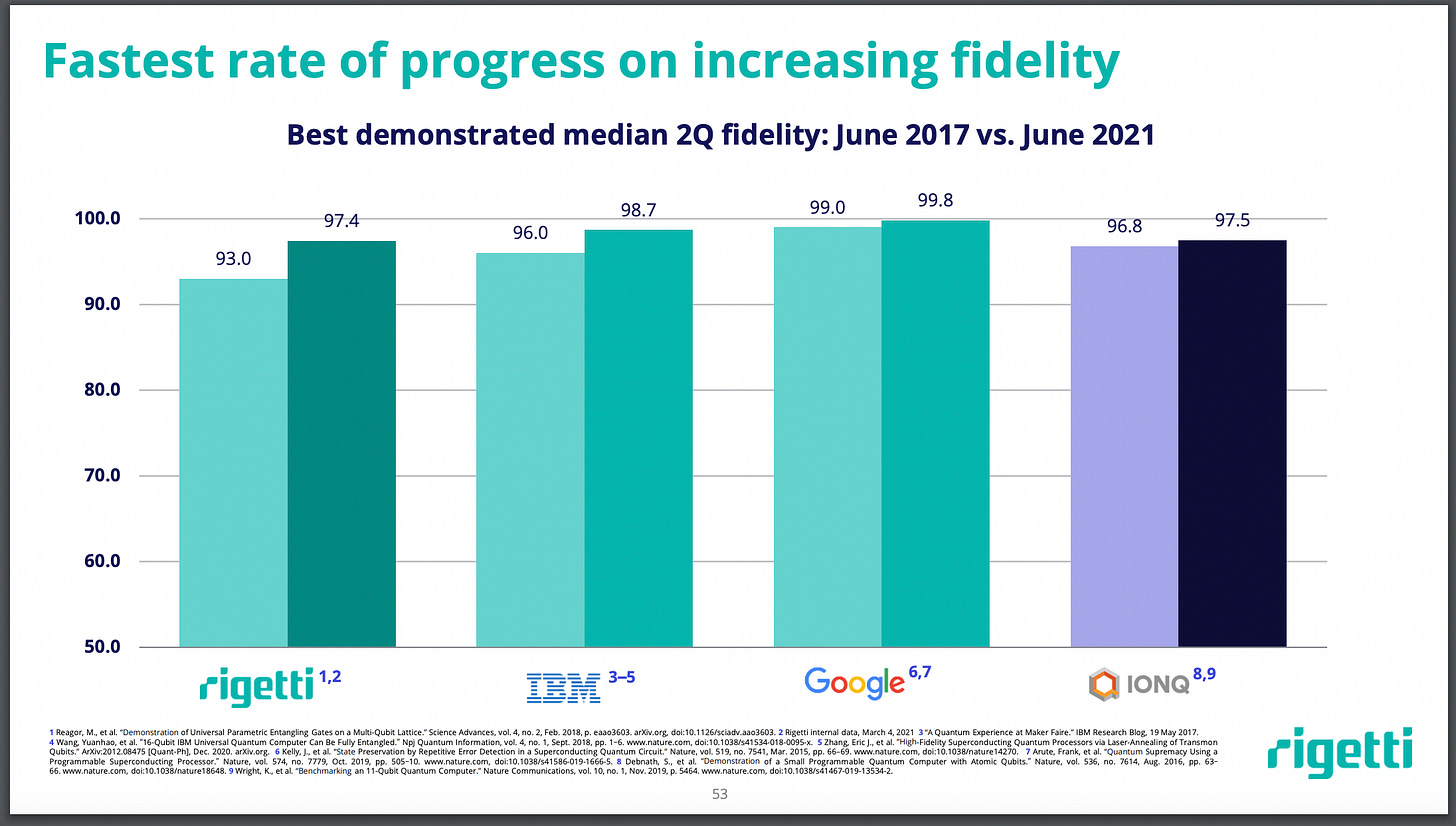

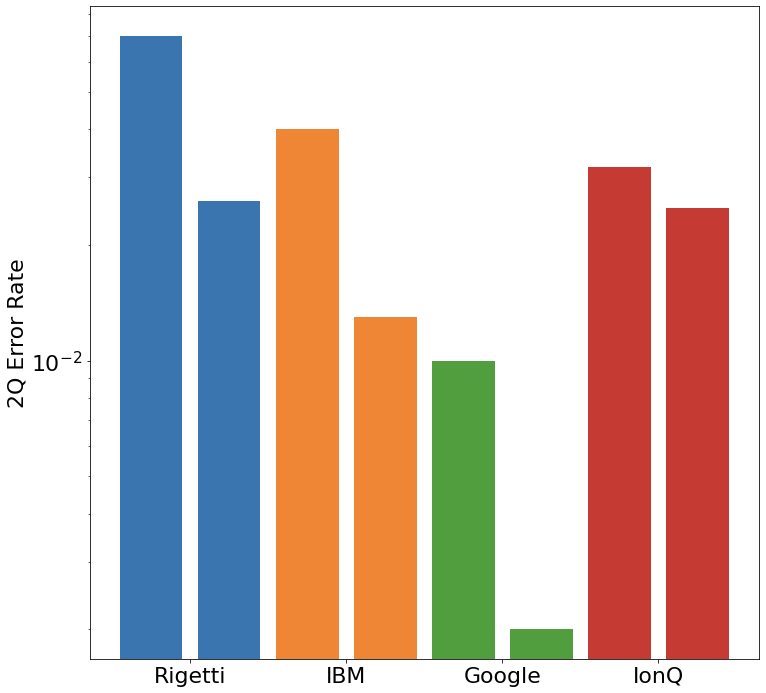

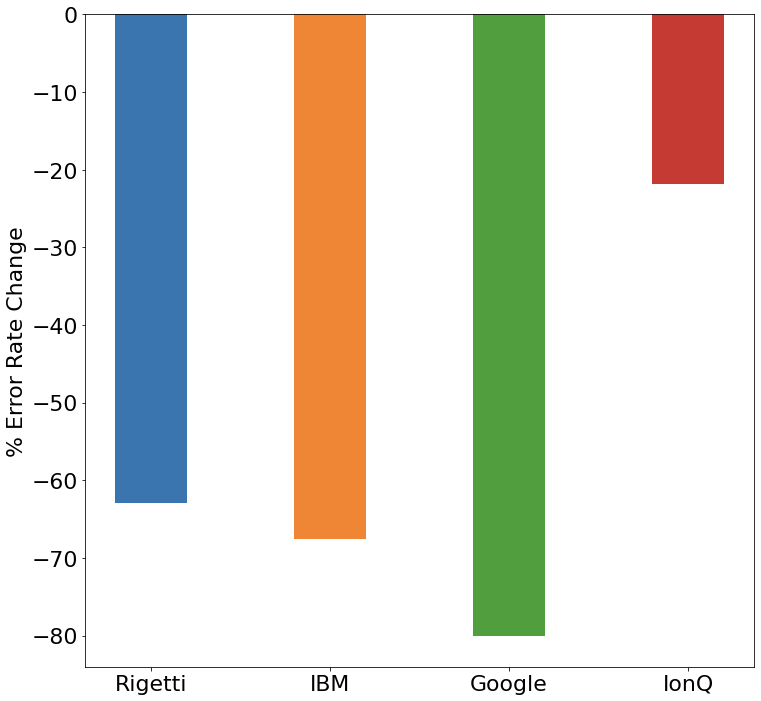

While we’re on the subject of 2 qubit gates, I will share with you the silliest slide, from deep in the supplemental materials.

I pretty strongly believe that beyond about 90% fidelity, these results should actually be presented as error rates (1 - Fidelity), because that shows how much errors have actually been suppressed. Error rates are a more ‘natural’ representation of the data. If you do the conversion, you get a plot like the one below, instead.

I set the scale on the y-axis to be logarithmic to better show how great a job Google has done. Perhaps the most informative plot would just be to plot % decrease in error between the two dates.

It’s clear here that Rigetti is actually lagging in 3rd behind Google and IBM in terms of rate of improvement in 2Q gate error reduction.

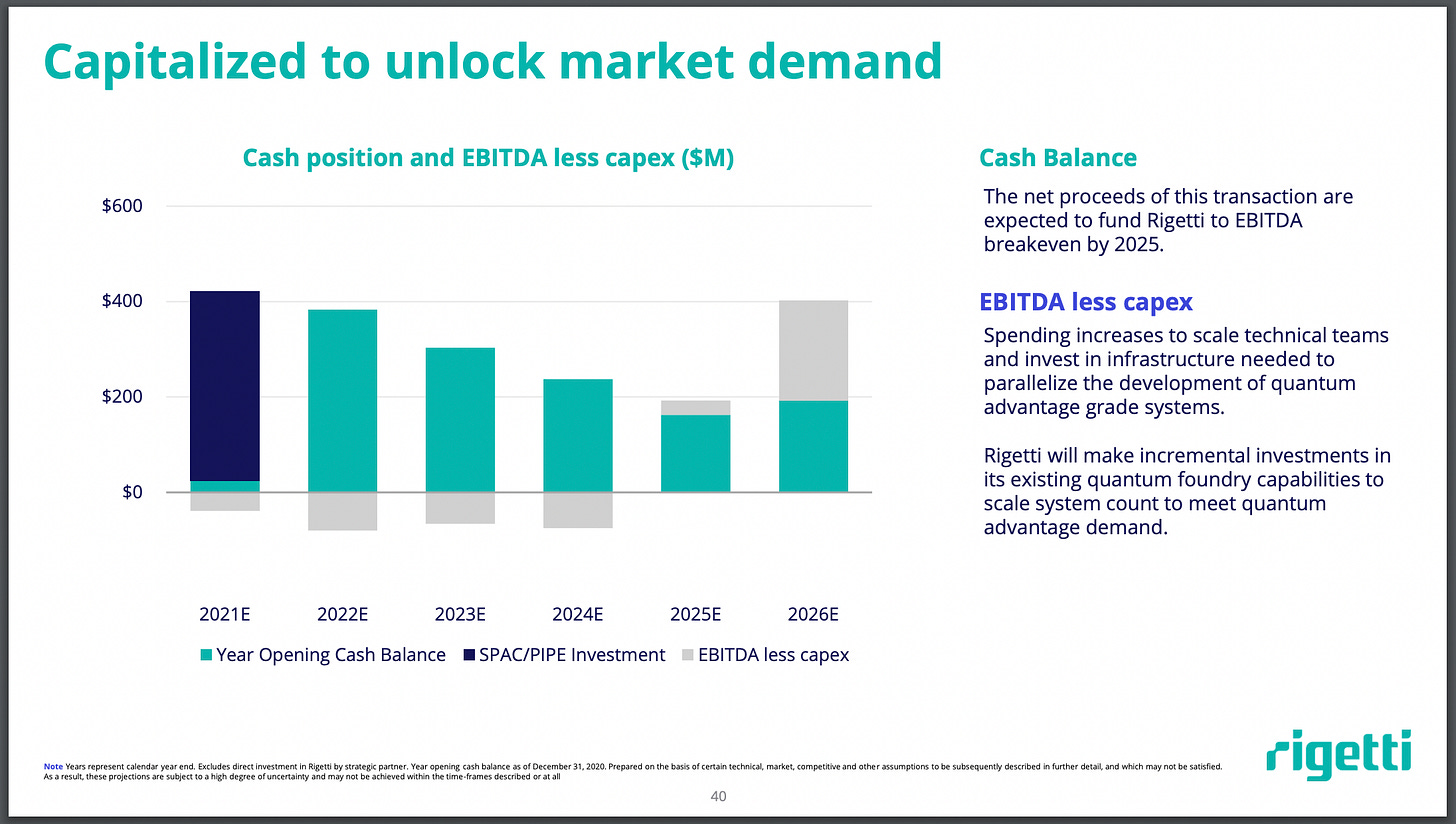

Lastly, I wanted to check out the spending/break-even slide.

I preferred IonQ’s version of this, because it’s not clear to me that EBITDA less capex is equivalent to free cash flow at all, so if they break even on ‘ebitda less capex’ are they actually making money? QC is going to be a capex heavy business for a while, so does it make sense to report ‘EBITDA less capex’? Sadly, I don’t know anyone who cares about shit like EBITDAs, so we’ll probably just never get these answers.

Just eyeballing this chart it seems like Rigetti will have maybe 1-2 years beyond 2025 if they miss these projections and keep spending. After that, I guess they issue more shares or get a loan or something (or implode, but optimism is the theme here).

To Gamble or Not to Gamble

At the end, the question for me is, do I buy shares of $RGTI (currently the ticker is $SNII until the merger and de-SPAC)? Thankfully, options are not yet available for $SNII, so the yoloing will have to wait.

We know that all of these QC efforts are super high risk, and I want to see QC succeed and breed more innovation, more incredible technology, and reach the Glorious Quantum Future. On the other hand, Rigetti does not have a great reputation among members of the superconducting qubit community (source: my informal network). Their Glassdoor reviews would be unremarkable, aside from this extremely detailed negative take. I’m also not convinced that Rigetti has any serious advantage over Google or IBM, nor that any advantage would be particularly durable. BUT, I don’t want to buy $GOOG or $IBM. Price movement in Google or IBM shares is likely to remain unrelated to QC for the foreseeable future, these companies have large profitable business ventures that basically fund their QC teams.

On the other hand, I did take a small long position in IonQ and, frankly, I’m more bullish on superconducting qubits than ions.

So what it comes down to is that I want QC to succeed, and I want Rigetti (or any company, really) to have a decent shot at doing it. Yeah, in addition to the ubiquitous technical hurdles, they appear to have some management problems as well. I don’t know if being a public company will help, but perhaps if they have a competent Board of Directors who take their oversight responsibilities seriously, we will see some improvements in the general opinion of Rigetti as a work environment, which should correlate to a better chance of ultimate success and profitability.

With all of that in mind, even with this sometimes ridiculous investor presentation, I’ll likely buy in.

If you’ve made it this far, why not subscribe? You get my updates into your inbox, and I get to see Number Go Up!